does instacart take out taxes for shoppers

Do Instacart take out taxes. Instacart does not take out taxes for independent contractors.

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

No taxes are taken out of your Doordash paycheck.

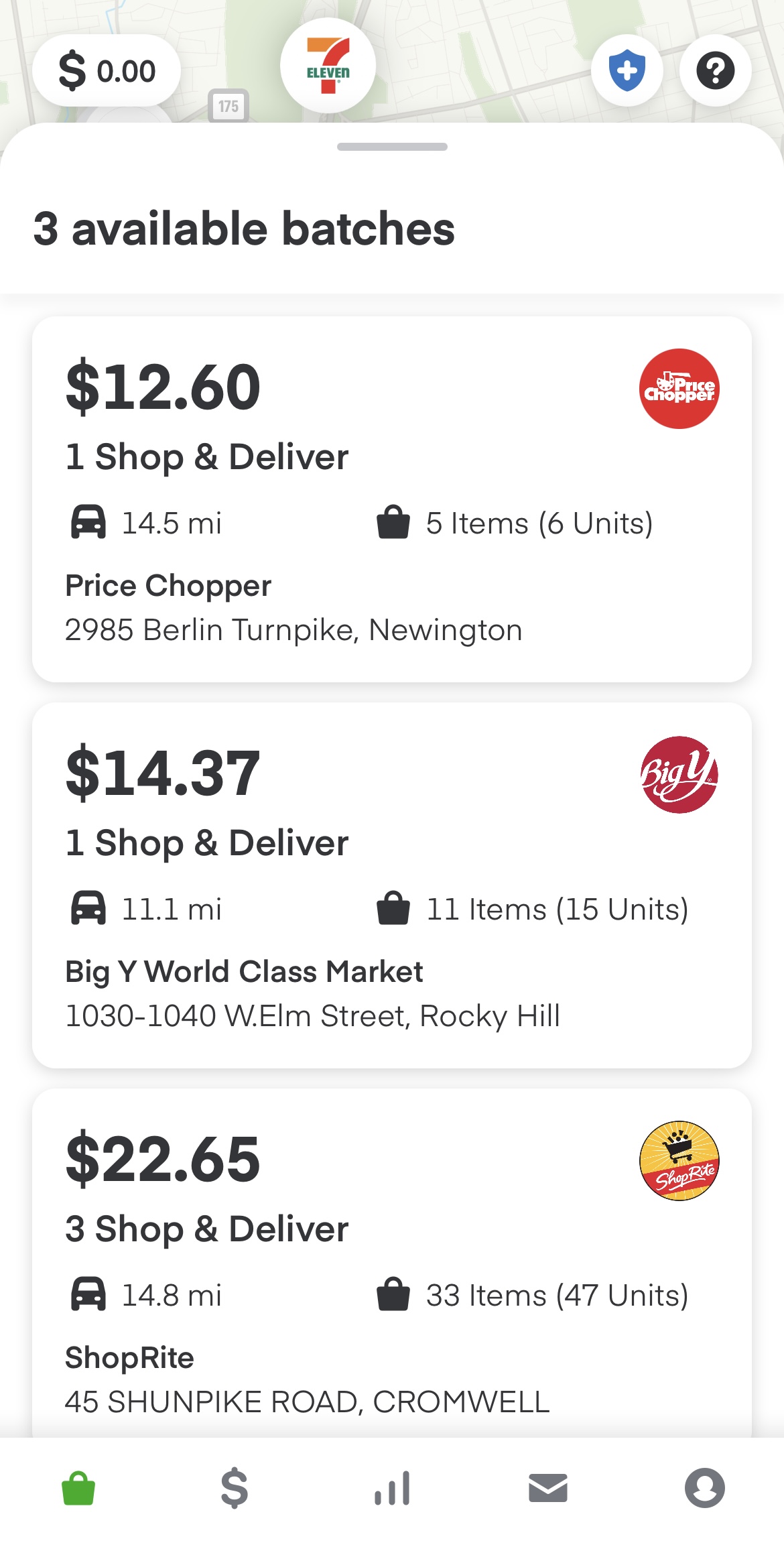

. The average base pay for an Instacart in-store shopper is about 13 per hour. Does Instacart take out taxes. You can set item and.

Heres how it works. Instacart makes it easy to communicate with your shopper. Instacart recommends a 5 tip which is much less than the average 15 restaurant tip.

However Instacart will automatically take out your taxes if youre an in-store shopper. Top Instacart Tax Deductions. Yes - in the US everyone who makes income pays taxes.

This is because youre an independent contractor so its your responsibility to accurately track and report your income. The IRS establishes the deadlines. Does Instacart take taxes out.

When are your taxes due. First fill out Schedule C with the amount you made as indicated in Box 7 on your Instacart 1099. 3015 reviews from Instacart Shoppers employees.

Taxes are required on the money you earn as a shopper just like any other type of income. Whatever your experience with Instacart you should know what to expect when it comes to taxes. As an Instacart driver you make cash by delivering staple goods to your clients home.

For its part-time shoppers Instacart doesnt take out taxes and they file W-2s. You can also use. Everybody who makes income in the US.

What kind of mileage can I deduct. This stuff applies just as much for Instacart Uber Eats Grubhub Postmates. You visit stores for example Whole Foods Costco and other participating nearby.

Instacart doesnt deduct taxes from Instacart Shoppers. This means that you have to cover all your own. Has to pay taxes.

When an item you want is out-of-stock at the store your shopper will follow your replacement preferences. If you make more than 600 per tax year theyll send you a 1099-MISC tax form. The short answer is no if youre an Instacart full-time shopper.

But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the. For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits. As an Instacart shopper here are seven deductions you should definitely be tracking.

Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. You do get to take off the 50 ER. The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis.

Only Customers shopping in Oklahoma with a 100 disabled veteran sales tax exemption card issued by the Oklahoma Tax Commission can contact Instacart Care to request a sales. For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year. Plan ahead to avoid a surprise tax bill when tax season comes.

Instacart shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year. Since full-service shoppers are considered independent contractors they may have to make estimated quarterly tax payments.

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

How To Get Instacart Tax 1099 Forms Youtube

First Time Ordering Instacart As A Customer Usually A Shopper Why In The Hell Is There Such A Massive Service Fee And Why Is It More Than The Payout Of Some Batches

Can Instacart Shoppers Rate Customers Yes And No

How To Work For Instacart What You Need To Know Rocket Resume

Does Instacart Track Mileage The Ultimate Guide For Shoppers

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

What You Need To Know About Instacart 1099 Taxes

Instacart Tipping Etiquette 2022 How Much To Tip Instacart Shoppers Dollarsanity

A Guide To Instacart Tipping How Much Should You Tip Your Shopper

How To Become An Instacart Shopper Your Guide Gobankingrates

How To Become An Instacart Shopper Pros Cons Pay Job Application

Instacart Shoppers Probably Aren T Independent Contractors Judge Rules Los Angeles Times

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom

How Much Do Instacart Shoppers Make 2021 Update Gridwise

I Was An Instacart Shopper I Had Enough When Someone Gave Me A 1 Star Review For Too Ripe Bananas Mother Jones

How Much Does Instacart Pay Shoppers Delivering Groceries For Cash